Note; How just one company - Amazon - is disrupting an entire industry. All the old stalwarts are falling apart because of this one company.

Here's Why Every Mall is Doomed

A nasty retreat in retail stocks is threatening to steal your Christmas gains…

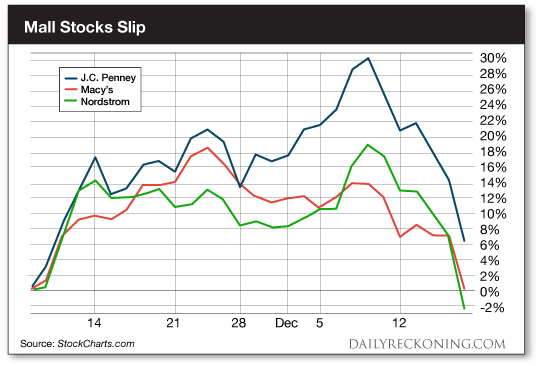

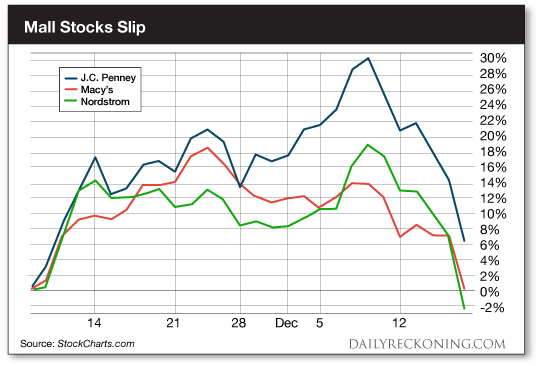

The great retail comeback is beginning to look shaky just weeks after posting a huge post-election breakout. Some of the biggest names in the sector are now starting to roll over.

If you’re stuck in any of these plays, you’ll have to act fast. If the breakdown we’re seeing is the real deal, it’s more proof that shopping malls are dying much faster than anyone anticipated. As the collapse accelerates, it threatens to shake the entire retail sector to its core…

Let’s face facts—retail hasn’t exactly been one of the friendliest investments of 2016. Heck, even one of the smartest investors in the world lost a pile of cash on a mall stock this year…

I’m talking about Greenlight Capital’s David Einhorn. Dave’s a billionaire—and he didn’t acquire his cash stash by accident. His fund has returned nearly 17% annually to investors since its inception in 1996.

But Einhorn’s having another rough year. His fund took a big stake in struggling retailer Macy’s (NYSE:M) in late 2015 only to watch shares implode nearly 30% before ditching the position altogether just six months later.

Sure, Macy’s was burning piles of cash and closing stores left and right. The former peddler of Donald J. Trump branded shirts and ties just couldn’t compete with the Amazon juggernaut. But the chain looked like it was getting its act together earlier this year. Shares started recovering as the company cut costs and closed underperforming stores.

Despite these improvements, the entire sector is suddenly falling apart.

The S&P Retail Index ETF (NYSE:XRT) hit the skids about midway through last year. But after bottoming out in February, XRT slowly started to get its act together. That’s when a post-election rally offered a shot of adrenaline to the beaten-down mall stocks. A mid-November surged helped power the retail ETF to gains of nearly 18% in a little less than a month. By early December, this group of stocks was flirting with new 52-week highs.

But after last weeks’ drubbing, it’s clear these stocks partied a little too hard after Trump’s win. Here comes the hangover…

CRASH ALERT! The exact day the U.S. dollar will collapse?

Be prepared by signing up for the Daily Reckoning today and receive your FREE Social Security lifeline report: Jim Rickards' Dollar Collapse Preparation Plan

We will NOT share your email address

All the major mall anchors are coughing up their November gains at an alarming rate. Nordstrom Inc. (NYSE:JWN) took the biggest hit Friday, dropping nearly 9% after a JP Morgan downgrade. Macy’s and JC Penney followed suit, each dropping 7% to finish out the trading week. The post-election retail rally is all but cooked…

The analyst note on the Nordstrom downgrade pulls no punches. Costs are too high. Online shopping is only cannibalizing brick-and-mortar sales. And store traffic is at its worst levels since 1972.

It gets worse…

The slow-motion collapse of the traditional retailers is starting to pick up steam. As this story continues to unfold, the retail sector is becoming a wasteland. Jeff Bezos and his army of same-day Amazon delivery drivers have gutted every brick and mortar store in their path. Derelict shopping malls dot the country. It’s not a pretty picture.

We’ve attempted to play the most recent bounce in retail this month without much success. Out main strategy was to seek out the discounters and specialty boutiques to survive trading in the brick-and-mortar space. After all, these are the shops that can offer something shoppers wouldn’t find online.

But even this move has been a total bust.

Steer clear of the retail space for now. You never know where Amazon will strike next…

No comments:

Post a Comment