Thursday, 29 December 2016

Wednesday, 28 December 2016

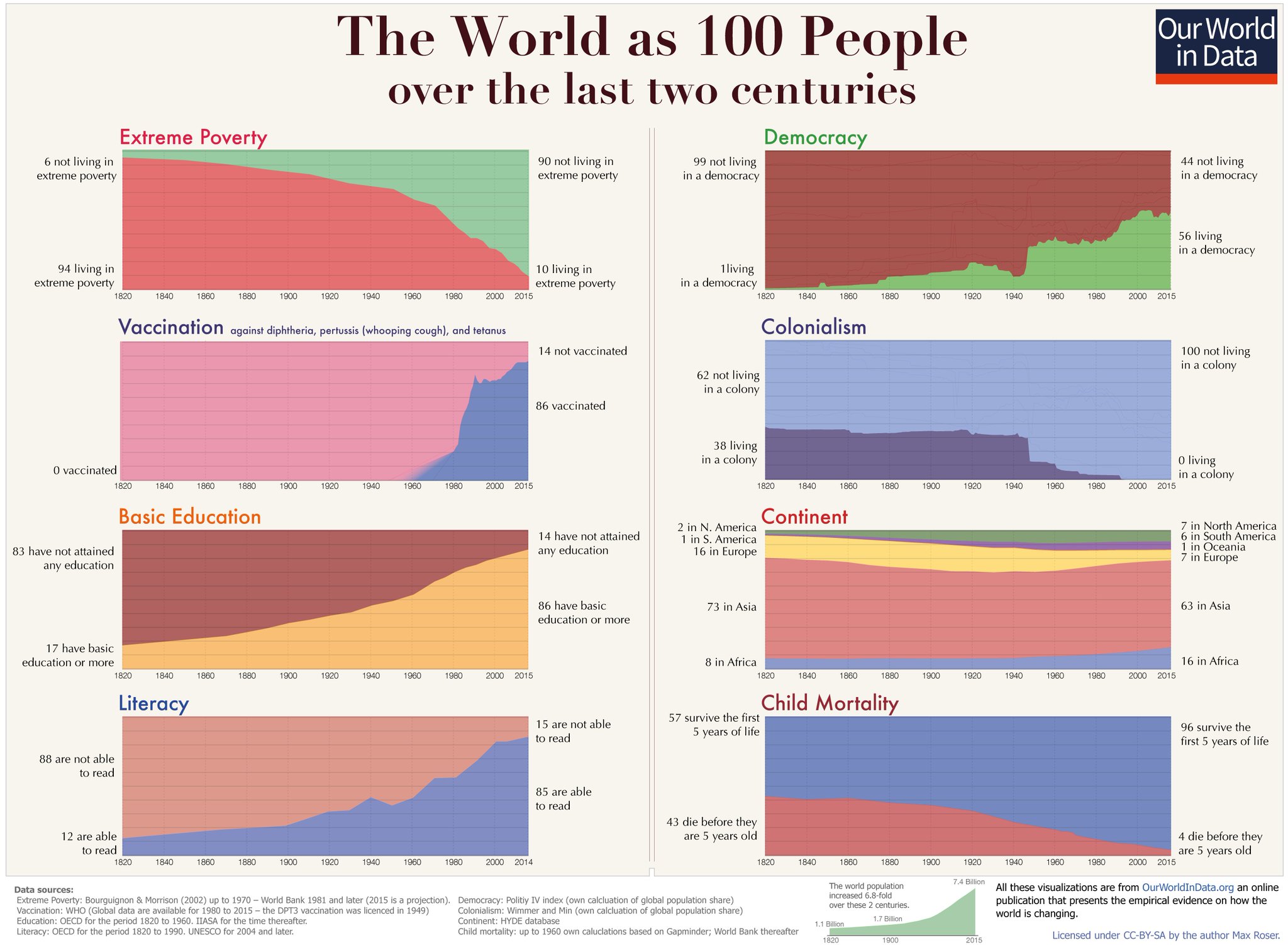

World poverty reduced from 95% to 10%, although population increased from 1.1bn to 7.4bn in the last 200 years

Note:

1. Overall, the world is a much better place. 90% are better off now. 90% were in abject poverty in 1800.

2. Europe saw the most decline in population percentage among the continents over the last 200 years. Although, the absolute population in Europe has increased from 200 million in 1800 to 500 million.

3. In Asia 73% of 1.1 billion i.e. approx 800 million people lived in 1800. Now, there are 63% of 7.4 billion i.e. approx 5 billion people in Asia.

4. North America saw the highest increase in population, from 200 million in 1800 to 500 million.

5. Roughly, the population of North America and Europe is similar both in 1800 and now.

https://pbs.twimg.com/media/C0NSXNuXAAIpUgN.jpg:large

Manufacturing vs branding - top 100 valuable brands are into branding, not manufacturing

Trump and Modi are aiming to create jobs through manufacturing. This is central part of their economic agenda.

A graduate student in Economics could explain the practical limitations of these ambitions. But if the concepts of wages and productivity are beyond then, all they need to do is look at Forbes list of world's most valuable brands.

They need not employ a researcher for this. Even a cursory glances at the Forbes list will drive home the point. 14 out of the top 20 most valuable brands int he world are American. A similar number in top 100 most valuable brands are American. No Indian brands exist in the top 100.

What’s this got to do with factory jobs? Just this: Most of these globally valuable brands do not make the bulk of their goods and services in their country of origin, for good reason. MBA 101 tells us that value addition, and therefore competitive advantage, lies in the ephemeral business of branding rather than in the tangible activity of manufacturing. As a businessman Mr Trump should understand this: He has made a fortune licensing his brand of gaudy realty around the world, and no American workers are involved in building those monstrosities.

However, they don't realize that value is created in branding, not manufacturing.

If wage inflation and exchange rates are making manufacturing costly in China, mega-corporations can choose from: Vietnam, Bangladesh, Laos and Cambodia, Sri Lanka, Honduras, even Jordan and Israel. India should be on that list, but isn’t because of that seventies law that severely curtails the flexibility of corporations to hire and fire in factories employing more than 100 workers. Which large corporation – Indian ones included – would like to take on the challenge of hiring more than 100 workers who can, in effect, never be fired?

Source: Article by Kanika Datta in Business Standard, Dec 29, 2016

Friday, 23 December 2016

People migrate from IKEA to Home Depot/Lowe's after a certain age

This is the age when many people stop shopping at Ikea

Published: Dec 23, 2016 3:11 a.m. ET

It turns out, there comes a point in your life when you may be too old for Ikea.

By

ALESSANDRA

MALITO

REPORTER

After moving out of his first apartment and into his first house with his wife, Robert Platt Bell, a patent attorney in Jekyll Island, Ga., knew he had outgrown Ikea furniture. He was 35.

He’s one of many people in their mid-30s who self-identify as too old to buy furniture from Ikea, the Swedish-based build-it-yourself home furnishings and decor company. The peak age of an Ikea shopper is 24, and popularity drops altogether after 34, according to anonymous transaction data gleaned from tens of thousands of loan applicants analyzed by student loans and personal loans lender Earnest.

Ikea is a one-stop shop, Bell said. “It caters to the ‘have it all’ mentality, where you can furnish an entire room in one afternoon.”

Younger shoppers are attracted to Ikea because of its low prices and sleek design. Aside from taste in decor, furniture choices depend on living situations — what works for a renter may not work in the long term for a homeowner. Take Bell, for example. He still has a few Ikea pieces but has opted in the past to sleep in a sleeping bag on the floor to save for a more expensive but, in his opinion, better bed. “In retrospect, I wish I had bought less Ikea furniture and bought high-end items because I ended up buying those things anyway,” he said.

Don’t miss: 5 ways Ikea persuaded shoppers to spend billions of dollars

Some people are never too old for Ikea, though. The furniture giant is all about “urban living on a budget,” but it’s also struck a nerve among the second-home set, as Elite Daily reported. In September, the store said it was opening more “click-and-collect” stores and reported that sales were up more than 7% to 34.2 billion euros (around $38.4 billion at the time) for the year ending Aug. 31, while same-store sales rose 4.8%. (Ikea declined to comment on the demographics study.)

The right furniture comes down to the right living scenarios. More expensive, though durable, furniture might not make sense for a renter who isn’t sure of her next steps or where she’ll live. “When you put down roots and buy your first-time home, you might feel the incentive to buy furniture that’s built to last,” said Catherine New, senior editor at Earnest. A $3,000 couch that costs $1,000 to move may not make sense.

Meanwhile, as Earnest data found, shoppers tend to migrate to stores like Crate & Barrel, the Container Store TCS, -2.25% and Williams-Sonoma WSM, -2.61% as they age and then later stores including Home Depot HD, -0.33% and Lowe’s LOW, -0.96% , suggesting a more hands-on approach to the home.

If you’re looking for furniture a bit more permanent, and are willing to spend a bit more, there are options. For some, it’s taking the plunge and spending more than a few thousand dollars on beds, mattresses and couches. For others, like Bell, it’s finding the value in hand-me-downs and curbside pieces that can become beautiful again with a little cleaning and reupholstering. “Furniture should be more than a temporary thing,” he said.

Wednesday, 21 December 2016

Investing is not a group activity, its a lone wolf game better suited for socially isolated people.

Sensex Blues

with 9 comments

Sensex has fallen only 10% but Financial stocks that I have been overweight have fallen anywhere between 30-50%, consequently my Indian portfolio has been down 30% from its highs.

Pendulum may be finally swinging in the depressed direction, but financial stocks are not going to recover in a hurry, not in the next 2-3 months at least.

I find the BSE SME market attractive, it has ~150 companies listed and a couple of attractive companies.

The great has been trolled with the average and the likely stocks to recover first will be Bharat Financial and Repco Home (currently not invested in either). New investors may say ‘I told you so’ with financial stocks, but I feel the money is mainly in this sector other than Pharma/Chemical/Consumer brands to be made. Manappuram for example which I started buying from 42 Rs in 2012 when from 22-105-60 within a 52 week period. Short term is hard to predict, who knows, it could go back to 30 Rs, but Long term, I believe it can be 300-500 Rs in 4-6 years, all going well. You have to diversify with financials and can’t afford a proverbial 3 stock Munger portfolio.

So, at this point like the Hospitals, Housing Finance companies (except PNB Housing ‘recency effect’), and unique micro / nano caps.

Good luck for 2017!

Cheers

9 Responses

Subscribe to comments with RSS.

- Thanks for sharing your views on Financials and wish you the very best for the new year.As a new investor, I am curious how do you deal with 30% drawdowns? Is it not emotionally challenging? Whats your framework to look at these sort of things?AbhishekDecember 21, 2016 at 6:49 am

- One has to pay this price to be in the markets. Even Berkshire has been down 50% twice. Goal is to survive. So, one can make from 1 to 5 and then lose a lot to get back to 2. Goal is to make higher lows and higher highs. It challenging and investing is not a group activity, its a lone wolf game better suited for socially isolated people.

https://lifeandequities.wordpress.com/2016/12/21/sensex-blues/?curator=alphaideas&utm_source=alphaideas

Oberoi realty success factors

My note:

1. In the first 10 years of starting the business, Oberoi realty built only 2 buildings in Andheri West.

2. Prior to building, the senior Oberoi was buying and selling apartments. That's when he made friendships with builders and understanding of the sector.

3. Buying of 60 acre land at Goregaon from Novartis for 100 crores in 2002 is what set them to becoming a big company. They purchased the land at a cheap price and got to participate in the ensuing realty boom over the next 10 years.

4. They focus on 'delivery quality' and 'being fair to customers' and 'operational efficiency' - note that these attributes of delivery quality, being fair, and operational efficiency are needed for a successful business in any field, not just realty. Be it running a small restaurant, a hospital, or just about any business.

Vikas Oberoi, chairman and MD of Oberoi Realty, believes that honesty is not just a virtue but also a good business strategy

Image: Joshua Navalkar

On a hot October day in 2015, around 400 people queued up in Borivali, in Mumbai’s western suburbs. No, they weren’t tech enthusiasts lined up in front of an Apple store to lay their hands on the latest iPhone. They were prospective home buyers, waiting outside a real estate developer’s sales office. Mumbai-based Oberoi Realty had just launched the sale of its new residential project, Oberoi Sky City, in the area, and they had turned up in droves.

No mean feat for a project that carries a minimum price tag of Rs 2.5 crore for an apartment. Not to mention the fact that four of the 10 residential towers planned were launched for sale, and in less than a year, 80 percent of the inventory of these four towers has already been sold.

“This is commendable in a scenario where the overall Mumbai property market remains sluggish, with most developers struggling to generate a good response to new launches,” says Adhidev Chattopadhyay, an analyst with Elara Capital, in a research note dated March 3, 2016. At that time, the inventory of unsold residential property in Mumbai had built up to 55 months of supply, according to the Elara report.

The response to the Borivali project wasn’t a one-off. A few months before Sky City, in January 2015, the developer had launched a residential project of twin towers in Mumbai’s eastern suburb of Mulund. Oberoi Realty has sold 80 percent of the inventory it launched for sale there as well.

This sustained ability to generate sales at new projects, despite a general slowdown in Mumbai’s residential real estate market, is noteworthy. Is there a secret sauce, Forbes India asks Vikas Oberoi, the company’s 46-year-old chairman and managing director. “Karma,” he says, referring to the spiritual principle that means that the intent and action of an individual influence his future. “One can use the principles of karma to build a better brand and that is what we have tried to do,” says Oberoi, who, in 2007, took over the reins of the company started by his father Ranvir Oberoi. His philosophy is simple—when you have good intentions, and deliver on promises, results follow. “We have been in the business for close to three decades and have been very consistent in delivering our projects according to the timelines and quality promised. We put our customers at the heart of our business and listen to them, study them, and predict their needs before they can articulate them.”

This sustained ability to generate sales at new projects, despite a general slowdown in Mumbai’s residential real estate market, is noteworthy. Is there a secret sauce, Forbes India asks Vikas Oberoi, the company’s 46-year-old chairman and managing director. “Karma,” he says, referring to the spiritual principle that means that the intent and action of an individual influence his future. “One can use the principles of karma to build a better brand and that is what we have tried to do,” says Oberoi, who, in 2007, took over the reins of the company started by his father Ranvir Oberoi. His philosophy is simple—when you have good intentions, and deliver on promises, results follow. “We have been in the business for close to three decades and have been very consistent in delivering our projects according to the timelines and quality promised. We put our customers at the heart of our business and listen to them, study them, and predict their needs before they can articulate them.”

An alumnus of the Owner/President Management programme at Harvard Business School, Oberoi has used the karma principle as the bedrock of his approach. It seems to have worked. Oberoi has seen his personal fortune soar enough for him to make a comeback to the 2016 Forbes India Rich List. Oberoi is ranked 89th, with a personal net worth of $1.45 billion. He ranked 84th in the 2014 edition of the list, but didn’t make the cut in 2015.

By virtue of his 72.54 percent holding in the company, Oberoi’s personal wealth has risen in tandem with an increase in the share prices of Oberoi Realty over the last one year—its stock price rose by 21.42 percent to close at Rs 321.55 per share on the BSE on October 10. In comparison, the benchmark S&P BSE Sensex gained a modest 4.37 percent over the same period. With a current market capitalisation of Rs 10,913 crore, Oberoi Realty is India’s second most valued real estate company behind DLF—a noteworthy achievement considering the developer only operates in Mumbai.

The company reported its highest-ever turnover in FY16 at Rs 1,444.30 crore, up by 53.6 percent over the previous year. Its net profit in the same period rose by 34.3 percent to Rs 425.91 crore. Its operating profit margin stood at a robust 48.72 percent in the last fiscal, though it was down from the 56.51 percent it reported in FY15.

Though a second-generation business leader, Oberoi has run his company with the mindset of a first-generation entrepreneur; and that probably has a lot to do with his keen interest in real estate.

In the ’70s and ’80s, Oberoi’s father was an investor in Mumbai’s real estate market, buying and selling apartments for a profit. In the process, he struck up friendships with several real estate developers and honed his understanding of the sector. Ranvir Oberoi then decided to turn developer himself. He liquidated all his investments in realty and started purchasing land instead.

“It wasn’t easy for him and it took around eight to ten years for him to build just two buildings (both in Andheri West),” says Oberoi. “But he set the platform.”

And Oberoi took to it all early. At 17, after attending classes at Mumbai’s Jai Hind College—where he was studying commerce—Oberoi would join his father by afternoon at his Nariman Point office. He observed, learnt and assisted his father for two decades, before taking over the reins of the company.

One of the earliest projects Oberoi worked closely on was in 2002, when the company successfully bid to acquire a 60-acre land parcel in Goregaon from pharmaceuticals company Novartis for Rs 107 crore. That plot has now been converted into Oberoi Realty’s signature development in Mumbai—Oberoi Garden City, a swanky residential-cum-commercial township which houses residential towers, a mall, two office buildings, a five-star hotel and a school.

It proved to be a business decision that the company is still reaping dividends from, as it continues to construct and sell new residential towers at this township. A new office space called Commerz II is also ready, with global MNCs like Teva Pharmaceutical Industries set to move in.

The next big achievement for Oberoi and his company came when, in 2007, it managed to secure an investment of Rs 675 crore—for a 10.75 percent stake in Oberoi Realty —from Morgan Stanley’s real estate investment arm. This was one of the earliest and largest foreign direct investments in the country’s real estate sector. The company followed this up with an IPO in 2010, through which it raised Rs 1,000 crore.

Cut to the present and Oberoi Realty has developed 39 projects across the city and delivered 9.18 million sq ft of real estate. It has another 20.61 million sq ft under development. This, when fully developed, has the potential to deliver a topline of Rs 25,000 crore and a net profit of Rs 12,000 crore for the company over the next five years, says Oberoi.

Oberoi attributes the present success of Oberoi Realty to the basics of business that he learnt from his father. “Whatever we do are derivatives of the fundamentals that he taught,” says Oberoi. “He was a big believer in not compromising on quality, being fair to customers and listening to them and improving operations.”

By believing that honesty is not only a virtue but “good business strategy as well”, he says, Oberoi Realty has been able to build credibility with stakeholders.

Vikas Oberoi with wife Gayatri

Image: Getty Images

For instance, he adds, Oberoi Realty brings a real estate project into the market only when all the necessary approvals are in place; and the cash flow that it generates from a project are first utilised towards the completion of that particular development. Which is why Oberoi Realty isn’t affected by the new Real Estate (Regulation and Development) Act that was passed by Parliament in May this year. The landmark piece of legislation, enacted by lawmakers to bring transparency to the real estate sector and protect the interests of investors, is likely to choke supply in the market as projects that don’t have all approvals in place cannot be marketed any longer.

“Uncertainty over regulations and several stuck projects have polarised demand towards reputed developers such as Oberoi Realty with a good execution track record,” says Kunal Lakhan, vice president, realty, at Axis Capital, in a research report dated August 22.

Not just customers, the efficient execution of a simple business model ensures that Oberoi Realty wins over lenders as well. As recently as in the first quarter of fiscal 2017, Incline Realty Private Ltd (a wholly owned subsidiary of Oberoi Realty) placed a new series of non-convertible debentures to raise Rs 750 crore at an impressive interest rate of 9.25 percent per annum.

“We got the debt real cheap. The interest rate at which we raised this money is similar to the cost at which many non-banking financial institutions raise money, just to lend it onwards,” Oberoi points out.

This is good news for the company since it is firming up its expansion strategy and may need to raise funds again. “With a healthy balance sheet, Oberoi Realty is well-poised to capitalise on opportunistic land deals,” the Axis Capital report says.

On the cards is a project being developed in Mumbai’s upscale Worli area called Three Sixty West; this is intended to be a confluence of super-premium residences and a five-star hotel, both to be managed by Ritz-Carlton. Oberoi, who has involved himself personally to ensure the success of this marquee project that can potentially generate $2 billion in sales, delayed bringing it into the market, despite having invested close to Rs 1,450 crore towards its development thus far. He wanted the apartments there to speak for themselves and therefore waited for the sample flat to be ready so that buyers would not need to rely on an artist’s impression. Since hitting the market in May 2016, sales from this project have taken off with meaningful velocity—apartments worth Rs 237 crore have been sold in the April-June quarter alone.

The successes of Three Sixty West and the Borivali and Mulund projects “speak volumes about the company’s brand equity, product attractiveness and cash flow strength,” a Motilal Oswal research report dated August 22 says.

Not far from Three Sixty West is another plot of land in Worli, which Oberoi Realty had acquired from pharmaceutical company Glaxo in 2003. After several alterations in the planned end-use of that land parcel, Oberoi Realty has decided to put up a mall there, says Oberoi. This may prove to be an alternative to the only other shopping mall between Nariman Point and Andheri in the western suburbs: The very successful High Street Phoenix in Lower Parel.

Oberoi Realty’s experience of developing and operating shopping malls has been promising as malls are a high margin business, and its mall in Goregaon clocked a turnover of Rs 94 crore in FY16, 95 percent of which went straight to the company’s operating profits.

“We will seriously explore new lines of business at Oberoi Realty such as development of more shopping malls, schools and health care facilities and some of these may become big chains in the future,” says Oberoi.

Even in its existing residential real estate business, the scope for upside is significant. This is because the company is yet to recognise a major portion of the revenues that it has already earned on account of apartments sold, in its profit and loss statement. Every residential project needs to meet a certain threshold linked to proportion of sales and construction costs, before revenues generated from it can be recognised in a developer’s income statement. As on June 30, the booking value of houses sold by Oberoi Realty totals Rs 9,280 crore, of which it has recognised sales of only Rs 4,859 crore on its books. The remaining portion will reflect in the company’s topline over the ensuing quarters.

Plus there are other developments that aren’t in the public domain. “There are a lot of agreements that we have signed that we don’t speak of till plans crystallise further,” Oberoi says.

1. In the first 10 years of starting the business, Oberoi realty built only 2 buildings in Andheri West.

2. Prior to building, the senior Oberoi was buying and selling apartments. That's when he made friendships with builders and understanding of the sector.

3. Buying of 60 acre land at Goregaon from Novartis for 100 crores in 2002 is what set them to becoming a big company. They purchased the land at a cheap price and got to participate in the ensuing realty boom over the next 10 years.

4. They focus on 'delivery quality' and 'being fair to customers' and 'operational efficiency' - note that these attributes of delivery quality, being fair, and operational efficiency are needed for a successful business in any field, not just realty. Be it running a small restaurant, a hospital, or just about any business.

Karma at work: Vikas Oberoi tides over the realty lull

By delivering as per promised quality and timelines, Vikas Oberoi has transformed his father's small firm into India's second-most valued real estate developer

BY AVEEK DATTA Forbes India Staff

PUBLISHED: Dec 21, 2016

Vikas Oberoi, chairman and MD of Oberoi Realty, believes that honesty is not just a virtue but also a good business strategy

Image: Joshua Navalkar

On a hot October day in 2015, around 400 people queued up in Borivali, in Mumbai’s western suburbs. No, they weren’t tech enthusiasts lined up in front of an Apple store to lay their hands on the latest iPhone. They were prospective home buyers, waiting outside a real estate developer’s sales office. Mumbai-based Oberoi Realty had just launched the sale of its new residential project, Oberoi Sky City, in the area, and they had turned up in droves.

No mean feat for a project that carries a minimum price tag of Rs 2.5 crore for an apartment. Not to mention the fact that four of the 10 residential towers planned were launched for sale, and in less than a year, 80 percent of the inventory of these four towers has already been sold.

“This is commendable in a scenario where the overall Mumbai property market remains sluggish, with most developers struggling to generate a good response to new launches,” says Adhidev Chattopadhyay, an analyst with Elara Capital, in a research note dated March 3, 2016. At that time, the inventory of unsold residential property in Mumbai had built up to 55 months of supply, according to the Elara report.

The response to the Borivali project wasn’t a one-off. A few months before Sky City, in January 2015, the developer had launched a residential project of twin towers in Mumbai’s eastern suburb of Mulund. Oberoi Realty has sold 80 percent of the inventory it launched for sale there as well.

An alumnus of the Owner/President Management programme at Harvard Business School, Oberoi has used the karma principle as the bedrock of his approach. It seems to have worked. Oberoi has seen his personal fortune soar enough for him to make a comeback to the 2016 Forbes India Rich List. Oberoi is ranked 89th, with a personal net worth of $1.45 billion. He ranked 84th in the 2014 edition of the list, but didn’t make the cut in 2015.

By virtue of his 72.54 percent holding in the company, Oberoi’s personal wealth has risen in tandem with an increase in the share prices of Oberoi Realty over the last one year—its stock price rose by 21.42 percent to close at Rs 321.55 per share on the BSE on October 10. In comparison, the benchmark S&P BSE Sensex gained a modest 4.37 percent over the same period. With a current market capitalisation of Rs 10,913 crore, Oberoi Realty is India’s second most valued real estate company behind DLF—a noteworthy achievement considering the developer only operates in Mumbai.

The company reported its highest-ever turnover in FY16 at Rs 1,444.30 crore, up by 53.6 percent over the previous year. Its net profit in the same period rose by 34.3 percent to Rs 425.91 crore. Its operating profit margin stood at a robust 48.72 percent in the last fiscal, though it was down from the 56.51 percent it reported in FY15.

Though a second-generation business leader, Oberoi has run his company with the mindset of a first-generation entrepreneur; and that probably has a lot to do with his keen interest in real estate.

In the ’70s and ’80s, Oberoi’s father was an investor in Mumbai’s real estate market, buying and selling apartments for a profit. In the process, he struck up friendships with several real estate developers and honed his understanding of the sector. Ranvir Oberoi then decided to turn developer himself. He liquidated all his investments in realty and started purchasing land instead.

“It wasn’t easy for him and it took around eight to ten years for him to build just two buildings (both in Andheri West),” says Oberoi. “But he set the platform.”

And Oberoi took to it all early. At 17, after attending classes at Mumbai’s Jai Hind College—where he was studying commerce—Oberoi would join his father by afternoon at his Nariman Point office. He observed, learnt and assisted his father for two decades, before taking over the reins of the company.

One of the earliest projects Oberoi worked closely on was in 2002, when the company successfully bid to acquire a 60-acre land parcel in Goregaon from pharmaceuticals company Novartis for Rs 107 crore. That plot has now been converted into Oberoi Realty’s signature development in Mumbai—Oberoi Garden City, a swanky residential-cum-commercial township which houses residential towers, a mall, two office buildings, a five-star hotel and a school.

It proved to be a business decision that the company is still reaping dividends from, as it continues to construct and sell new residential towers at this township. A new office space called Commerz II is also ready, with global MNCs like Teva Pharmaceutical Industries set to move in.

The next big achievement for Oberoi and his company came when, in 2007, it managed to secure an investment of Rs 675 crore—for a 10.75 percent stake in Oberoi Realty —from Morgan Stanley’s real estate investment arm. This was one of the earliest and largest foreign direct investments in the country’s real estate sector. The company followed this up with an IPO in 2010, through which it raised Rs 1,000 crore.

Cut to the present and Oberoi Realty has developed 39 projects across the city and delivered 9.18 million sq ft of real estate. It has another 20.61 million sq ft under development. This, when fully developed, has the potential to deliver a topline of Rs 25,000 crore and a net profit of Rs 12,000 crore for the company over the next five years, says Oberoi.

Oberoi attributes the present success of Oberoi Realty to the basics of business that he learnt from his father. “Whatever we do are derivatives of the fundamentals that he taught,” says Oberoi. “He was a big believer in not compromising on quality, being fair to customers and listening to them and improving operations.”

By believing that honesty is not only a virtue but “good business strategy as well”, he says, Oberoi Realty has been able to build credibility with stakeholders.

Vikas Oberoi with wife Gayatri

Image: Getty Images

“Uncertainty over regulations and several stuck projects have polarised demand towards reputed developers such as Oberoi Realty with a good execution track record,” says Kunal Lakhan, vice president, realty, at Axis Capital, in a research report dated August 22.

Not just customers, the efficient execution of a simple business model ensures that Oberoi Realty wins over lenders as well. As recently as in the first quarter of fiscal 2017, Incline Realty Private Ltd (a wholly owned subsidiary of Oberoi Realty) placed a new series of non-convertible debentures to raise Rs 750 crore at an impressive interest rate of 9.25 percent per annum.

“We got the debt real cheap. The interest rate at which we raised this money is similar to the cost at which many non-banking financial institutions raise money, just to lend it onwards,” Oberoi points out.

This is good news for the company since it is firming up its expansion strategy and may need to raise funds again. “With a healthy balance sheet, Oberoi Realty is well-poised to capitalise on opportunistic land deals,” the Axis Capital report says.

On the cards is a project being developed in Mumbai’s upscale Worli area called Three Sixty West; this is intended to be a confluence of super-premium residences and a five-star hotel, both to be managed by Ritz-Carlton. Oberoi, who has involved himself personally to ensure the success of this marquee project that can potentially generate $2 billion in sales, delayed bringing it into the market, despite having invested close to Rs 1,450 crore towards its development thus far. He wanted the apartments there to speak for themselves and therefore waited for the sample flat to be ready so that buyers would not need to rely on an artist’s impression. Since hitting the market in May 2016, sales from this project have taken off with meaningful velocity—apartments worth Rs 237 crore have been sold in the April-June quarter alone.

The successes of Three Sixty West and the Borivali and Mulund projects “speak volumes about the company’s brand equity, product attractiveness and cash flow strength,” a Motilal Oswal research report dated August 22 says.

Not far from Three Sixty West is another plot of land in Worli, which Oberoi Realty had acquired from pharmaceutical company Glaxo in 2003. After several alterations in the planned end-use of that land parcel, Oberoi Realty has decided to put up a mall there, says Oberoi. This may prove to be an alternative to the only other shopping mall between Nariman Point and Andheri in the western suburbs: The very successful High Street Phoenix in Lower Parel.

Oberoi Realty’s experience of developing and operating shopping malls has been promising as malls are a high margin business, and its mall in Goregaon clocked a turnover of Rs 94 crore in FY16, 95 percent of which went straight to the company’s operating profits.

“We will seriously explore new lines of business at Oberoi Realty such as development of more shopping malls, schools and health care facilities and some of these may become big chains in the future,” says Oberoi.

Even in its existing residential real estate business, the scope for upside is significant. This is because the company is yet to recognise a major portion of the revenues that it has already earned on account of apartments sold, in its profit and loss statement. Every residential project needs to meet a certain threshold linked to proportion of sales and construction costs, before revenues generated from it can be recognised in a developer’s income statement. As on June 30, the booking value of houses sold by Oberoi Realty totals Rs 9,280 crore, of which it has recognised sales of only Rs 4,859 crore on its books. The remaining portion will reflect in the company’s topline over the ensuing quarters.

Plus there are other developments that aren’t in the public domain. “There are a lot of agreements that we have signed that we don’t speak of till plans crystallise further,” Oberoi says.

Tuesday, 20 December 2016

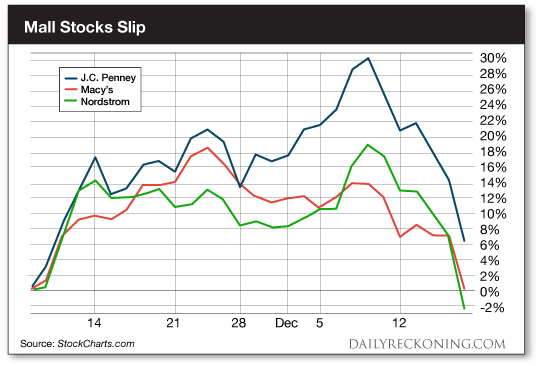

Retail is tough business (with the advent of strong online player like Amazon)

Note; How just one company - Amazon - is disrupting an entire industry. All the old stalwarts are falling apart because of this one company.

Here's Why Every Mall is Doomed

A nasty retreat in retail stocks is threatening to steal your Christmas gains…

The great retail comeback is beginning to look shaky just weeks after posting a huge post-election breakout. Some of the biggest names in the sector are now starting to roll over.

If you’re stuck in any of these plays, you’ll have to act fast. If the breakdown we’re seeing is the real deal, it’s more proof that shopping malls are dying much faster than anyone anticipated. As the collapse accelerates, it threatens to shake the entire retail sector to its core…

Let’s face facts—retail hasn’t exactly been one of the friendliest investments of 2016. Heck, even one of the smartest investors in the world lost a pile of cash on a mall stock this year…

I’m talking about Greenlight Capital’s David Einhorn. Dave’s a billionaire—and he didn’t acquire his cash stash by accident. His fund has returned nearly 17% annually to investors since its inception in 1996.

But Einhorn’s having another rough year. His fund took a big stake in struggling retailer Macy’s (NYSE:M) in late 2015 only to watch shares implode nearly 30% before ditching the position altogether just six months later.

Sure, Macy’s was burning piles of cash and closing stores left and right. The former peddler of Donald J. Trump branded shirts and ties just couldn’t compete with the Amazon juggernaut. But the chain looked like it was getting its act together earlier this year. Shares started recovering as the company cut costs and closed underperforming stores.

Despite these improvements, the entire sector is suddenly falling apart.

The S&P Retail Index ETF (NYSE:XRT) hit the skids about midway through last year. But after bottoming out in February, XRT slowly started to get its act together. That’s when a post-election rally offered a shot of adrenaline to the beaten-down mall stocks. A mid-November surged helped power the retail ETF to gains of nearly 18% in a little less than a month. By early December, this group of stocks was flirting with new 52-week highs.

But after last weeks’ drubbing, it’s clear these stocks partied a little too hard after Trump’s win. Here comes the hangover…

CRASH ALERT! The exact day the U.S. dollar will collapse?

EXCLUSIVE CONTENT

Be prepared by signing up for the Daily Reckoning today and receive your FREE Social Security lifeline report: Jim Rickards' Dollar Collapse Preparation Plan

We will NOT share your email address

All the major mall anchors are coughing up their November gains at an alarming rate. Nordstrom Inc. (NYSE:JWN) took the biggest hit Friday, dropping nearly 9% after a JP Morgan downgrade. Macy’s and JC Penney followed suit, each dropping 7% to finish out the trading week. The post-election retail rally is all but cooked…

The analyst note on the Nordstrom downgrade pulls no punches. Costs are too high. Online shopping is only cannibalizing brick-and-mortar sales. And store traffic is at its worst levels since 1972.

It gets worse…

The slow-motion collapse of the traditional retailers is starting to pick up steam. As this story continues to unfold, the retail sector is becoming a wasteland. Jeff Bezos and his army of same-day Amazon delivery drivers have gutted every brick and mortar store in their path. Derelict shopping malls dot the country. It’s not a pretty picture.

We’ve attempted to play the most recent bounce in retail this month without much success. Out main strategy was to seek out the discounters and specialty boutiques to survive trading in the brick-and-mortar space. After all, these are the shops that can offer something shoppers wouldn’t find online.

But even this move has been a total bust.

Steer clear of the retail space for now. You never know where Amazon will strike next…

Monday, 19 December 2016

Land prices in Hyderabad - highest is Rs. 29 crores per acre (near Gachibowli and Hitech city)

Land prices in Hyderabad - Rs. 29 crores per acre (2015)

Aurobindo pharma purchased 5 acres in Raidurgam (near IT hub of Gachibowli and Hitech city) at a price of Rs. 29 crores per acre in a government auction.

Aurobindo purchased another parcel of the land in the same area at a price of Rs. 24 crores per acre.

Naya Infra purchased two acres of land in Raidurgam at a price of Rs.24.20 crore per acre.

Saimed Labs paid Rs.22.02 crore per acre for a three acre parcel.

Officials said this broke all previous records. Even during the boom time in 2007-08, the auction of government land in Raidurgam had only fetched Rs.18 crore to Rs.23 crore per acre.

The companies, which purchased the land in the auction conducted by Telangana State Industrial Infrastructure Corporation (TSIIC), plan to build world-class corporate headquarters.

The government body also auctioned lands in Manikonda and Kokapet areas for residential use. The price also broke previous records. A real estate company paid Rs.12.63 crore for an acre in Manikonda while an acre land in Kokapet fetched Rs.6.05 crore to the government.

http://www.mid-day.com/articles/land-price-in-hyderabad-breaks-all-records-an-acre-fetches-rs-29-crore/16715172

Land prices near Navi Mumbai airport - Rs. 10 crores to Rs. 20 crores per acre

http://timesofindia.indiatimes.com/city/mumbai/Land-given-to-villagers-near-new-airport-selling-for-20cr-an-acre/articleshow/51354081.cms

Aurobindo pharma purchased 5 acres in Raidurgam (near IT hub of Gachibowli and Hitech city) at a price of Rs. 29 crores per acre in a government auction.

Aurobindo purchased another parcel of the land in the same area at a price of Rs. 24 crores per acre.

Naya Infra purchased two acres of land in Raidurgam at a price of Rs.24.20 crore per acre.

Saimed Labs paid Rs.22.02 crore per acre for a three acre parcel.

Officials said this broke all previous records. Even during the boom time in 2007-08, the auction of government land in Raidurgam had only fetched Rs.18 crore to Rs.23 crore per acre.

The companies, which purchased the land in the auction conducted by Telangana State Industrial Infrastructure Corporation (TSIIC), plan to build world-class corporate headquarters.

The government body also auctioned lands in Manikonda and Kokapet areas for residential use. The price also broke previous records. A real estate company paid Rs.12.63 crore for an acre in Manikonda while an acre land in Kokapet fetched Rs.6.05 crore to the government.

http://www.mid-day.com/articles/land-price-in-hyderabad-breaks-all-records-an-acre-fetches-rs-29-crore/16715172

Land prices near Navi Mumbai airport - Rs. 10 crores to Rs. 20 crores per acre

http://timesofindia.indiatimes.com/city/mumbai/Land-given-to-villagers-near-new-airport-selling-for-20cr-an-acre/articleshow/51354081.cms

Delhi most prime area land price is Rs. 100 crores to Rs. 300 crores per acre

The Lutyens Bungalow Zone – a 100-year-old neighbourhood in New Delhi – is perhaps India’s most elite residential location.

The Lutyens Bungalow Zone (LBZ) covers about 3,000 acres

and spans 28.73 sq km,

with about 1,000 bungalows,

out of which only 65-70 are for private use.

The rest are reserved for ministers and government officials.

Compared to some parts of east and Old Delhi, where approximately 1,100 to 1,600 people live per acre of space, the density in the bungalow zone is just 14-15 people because of the low-density development.

Renuka Talwar, daughter of DLF Chiarman, purchased about 1.2 acre with house in Lutyen's Delhi area for Rs. 435 crores (Rs. 350 crore per acre) - Dec 2016

- 4,925 square metre plot

- Bunglow has a built up area of 1,200 square metre

- Rs. 8.8 lakhs per square metre

Last big transaction on Prithviraj road (Rs. 100 crores per acre) - Sept 2015

- Purchase by Shahi Exports' Harish Ahuja for Rs. 173 crores

- 2,650 sq metres (about 1.5 acres) plot

- 800 sq metres built up

- Rs. 6.5 lakhs per sq metre

"This year has been a little dull year in Lutyen's Delhi area. There is a price mismatch between buyers and sellers." says CEO JLL India.

2015 deals in the area

- Dabur's chairman VC Burman purchased a bunglow in Golf Links for Rs. 160 crores (dec 2015)

- Essel Group (Subhash Chandra's) bought 2.8 acres on Bhagawan Das Road for Rs. 304 crores (Rs. 100 crores per acre). A similar property in Greater Kailash, another affluent neighbourhood in the capital, would cost at least Rs 100 crore less.

- Rajiv Rattan (Indiabulls group cofounder) purchased 2,920 square yards (about 60 cents) on Amrita Shergill Marg for Rs. 220 crores (Rs. 350 crores per acre)

- Kabul Chawla of BPTP realestate firm bought 575 sq yards for Rs. 65 crores (about Rs. 500 crores per acre)

Your note:

1. There are restrictions on building apartments in these areas. Otherwise, the prices could be much higher. Current rules do not allow for high-rise constructions, since the bungalows have a heritage value. If an old bungalow is to be reconstructed, it has to retain the height of the original structure. Lutyens Bungalows are usually six metres high.

2. Smaller plots command higher value (e.g. Kabul Chawla purchase above)

3. About 1,000 people per acre in densest parts of Old Delhi

http://economictimes.indiatimes.com/wealth/real-estate/dlf-boss-daughter-renuka-talwar-buys-bungalow-in-lutyens-bungalow-zone-for-rs-435-crore/articleshow/56055425.cms

http://scroll.in/article/754724/lutyens-delhi-may-be-about-to-change-for-good

http://www.hindustantimes.com/delhi/delhi-real-estate-boom-coming-as-lutyens-zone-set-to-shrink/story-u2bccMQBpBrxYXjteuIw0M.html

Thursday, 15 December 2016

What technical skills does a superstar trader have that the other traders do not?

What separated traders like John Arnold and Steve Cohen from the rest? What skills and qualities?

Please keep your answers more technical than soft. We know they were smart, risk taking, and read a lot of books, etc.

Kirubakaran Rajendran, Stock Market Algo Trader, Founder, www.squareoff.in

Unfortunately, everybody believes that a successful trader always has a secret Technical Skill. But the truth is Technical skill is the least important factor to be a superstar trader. Then what separates a great trader from the group of average traders?

Its their emotion.

Trading is the only profession where you can see Doctors, Engineers, and many other successful professionals try their luck with stock market, these people excel in their own respective field but struggle a lot when it comes to trading.

The successful traders have an amazing emotional discipline to follow their trading rules no matter what. They have a strong conviction with their trading decisions, they dont keep changing it and doesn’t react much with market fluctuations. John Paulson is one of the best example of a greatest trader who made billions due to his strong conviction about his trading decision.

If you have read this book, you will understand why emotion or trading psychology is more important than any other skills. If the you dont read the book, I would recommend watching the movie The Big Short.

So the key to be a successful trader is just one thing “Emotional Discipline”

Monday, 12 December 2016

Month wise trading returns of an Indian trader who trades with high amount of capital (2016)

| 100 | |

| 6% | 106 |

| 14% | 121 |

| 25% | 151 |

| 11% | 168 |

| 8% | 181 |

| -10% | 163 |

| -18% | 134 |

| 0.50% | 134 |

| 2% | 137 |

| 2% | 140 |

| 21% | 169 |

http://www.portfolioyoga.com/wp/becoming-a-trader/?curator=alphaideas&utm_source=alphaideas

Saturday, 10 December 2016

Globalization takes shape in three distinct stages: the ability to move goods, then ideas, and finally people

Brace yourself: the most disruptive phase of globalization is just beginning

Brace yourself: the most disruptive phase of globalization is just beginning

Model worker. (Reuters/Fabrizio Bensch)

To properly understand globalization, you need to start 200,000 years ago.

Richard Baldwin skillfully takes on this daunting task in a new book, starting all the way back with the hunter-gatherers. For too long, he says, traditional analysis of trade has been too narrow, he argues.

The economist, who is a professor at the Graduate Institute in Geneva and president of the Centre for Economic Policy Research (CEPR) in London, has been researching globalization and trade for 30 years. As anti-globalization forces now sweep across the world, The Great Convergence: Information Technology and the New Globalization (Harvard University Press) is well timed.

Baldwin argues that globalization takes shape in three distinct stages: the ability to move goods, then ideas, and finally people. Since the early 19th century, the cost of the first two has fallen dramatically, spurring the surge in international trade that is now a feature of the modern global economy.

The standard line from politicians in recent times is that everyone wins from globalization. But the backlash from low-skilled workers who lost their jobs to cheaper labor abroad has forced a change in tone.

Mark Carney, the governor of the Bank of England, gave a candid speech on globalization in northwest England this week, where unemployment is among the highest in the country. He said:

Amongst economists, a belief in free trade is totemic. But, while trade makes countries better off, it does not raise all boats… the benefits from trade are unequally spread across individuals and time.

A better understanding of globalization is more urgent than ever, Baldwin says, because the third and most disruptive phrase is still to come. Technology will bring globalization to the people-centric service sector, upending far more jobs in rich countries than the decline in manufacturing has in recent decades. (In the UK, the service sector accounts for almost 80% of the economy; less than 10% of US jobs are in manufacturing.) The disruption won’t come because people will move more freely across borders, but because technologies will provide “a substitute for being there,” Baldwin says.

Baldwin spoke with Quartz at the CEPR’s London office about technology’s role in the future of globalization. The conversation has been edited and condensed.

Your book starts with an interesting chart on the share of global income owned by G7 countries. What does it tell us about the early phases of globalization?

When there wasn’t massive trade, every city and every village had its own butcher, baker, candlestick maker, and the bonfire of innovation in modern growth couldn’t get going. For a millennium, incomes for human civilization were stagnate. It wasn’t until 1820 or so, when you could move goods over long distances, that we started to see big factories and industrial clusters happening. But it was hard to move ideas over distance so those ideas stayed in the North. That was the Great Divergence. The North, the G7 more or less, had knowledge-driven growth that took off sooner and faster than the developing countries.

And this lasted a very long time.

For almost two centuries, basically all of what we call globalization. The G7 share rose from about a fifth to two-thirds in 170 years.

By the end of this whole thing, around 1990, there was a massive imbalance between know-how per worker in the rich countries and in the nearby poor countries. The information and communication technology revolution allowed the firms to move the knowledge across borders. This was transformative in rich countries, where it led to deindustrialization, and a wonderful thing in nearby developing countries, which saw rapid growth, rapid industrialization, and 650 million people rise out of poverty.

The steepness of the decline from 1990 in the chart is quite something. Is this sudden change what upsets people?

The suddenness is one element. For example, Bombardier, a Canadian firm, moved the production of the tail of one of its aircraft from Canada to Mexico in a matter of months. The second thing is that globalization was very individual. The globalization was not hitting the whole sector or a single skill group; it was breaking everyone up on their own.

You mean within companies?

Within companies, within factories, within industries. There were winners and losers, which were more finely defined than in the old globalization. It’s got nothing to do with skills. That sort of sudden, unpredictable, individual aspect of globalization has made everybody very anxious, frustrated, and afraid.

This explains a lot about Donald Trump’s election and the Brexit vote, which were able to tap into a lot of those concerns.

Absolutely. The rage is rational but the reaction is not. My story of knowledge-driven globalization has technology at the heart of it. American workers are competing with robots at home and China abroad, and neither one is going well.

People want to blame trade and immigration, and politicians want to address these concerns. But are people directing their anger at the wrong culprits? And if so, what to make of the way politicians are now scrambling to roll back trade agreements and curb immigration?

It’s a misdiagnosis of the problem. When Dyson offshored its jobs from the UK to Malaysia it wasn’t moving goods but technology. What happened there would not have been stopped by tariffs. What you end up with is trying to treat a 21st-century problem with 20th-century tools, and you get all sorts of unintended effects. In any case, it just won’t work. In the case of the UK and Brexit, the Brexiteers were all talking about leaving the European Union and so Nissan went and explained to the government the reality of modern manufacturing. The UK’s motoring industry is part of factory Europe: they need that back and forth movement of goods, services, people, intellectual property rights. Without that, the factory shuts down.

It sounds like a recipe for making angry people even angrier.

Boy, are they going to be angry!

What about Donald Trump’s promise to bring back US manufacturing jobs? He made a deal to keep nearly 1,000 jobs at the Carrier gas-furnace factory by offering a big tax break.

We shouldn’t try and protect jobs; we should protect workers. It’s really a fool’s errand to struggle with because after a year or two those jobs will still go. Either they will be replaced by robots or they’ll move to Mexico or China. If Carrier becomes inefficient from being forced to stay in the US, its business will go to competitors in Japan or Germany.

So even if we put up trade barriers, the jobs we protect will be for robots, not people?

Absolutely. There are jobs for people, even in manufacturing these days, but not for the low-skilled people who have been dispossessed by this. Their jobs were routine and the easiest to replace with automation. The first thing to do is accept the 21st–century reality that no matter what you do, these jobs aren’t coming back.

An important aspect of your book is that we still have the so-called third phase of globalization to come, which will drive down the cost of moving people.

There are two technologies that are key: telepresence and telerobotics. They exist but are expensive and clunky. Telepresence is half of a table with life-size screens, good light, lots of cameras, and microphones. Then the other half of the table is somewhere else. When people sit at the table you have a very strong impression that they are in the same room.

So the “movement” of people is not physical?

It’s a substitute for being there. It’s Skype that’s really, really good.

The second is telerobotics. There are a couple of well-known ones. One is the surgeon operating at a 100-kilometer distance from the patient. But you can imagine that hotel rooms in London could be cleaned by people driving robots sitting in Kenya or Buenos Aires or wherever, for a tenth of the cost here. That’s coming, and it will be very disruptive.

What happens to the chart on global income distribution during this phase of globalization?

It keeps going down. It will be disruptive in the G7, but instead of just in the manufacturing sector, it spreads to services. Only about 10-15% of the population works directly in manufacturing in the G7—the rest work in services. It will create great opportunities in many of the countries that have been left behind by earlier globalization, for instance almost all of sub-Saharan Africa and South America.

You say governments need to do more for the losers of globalization. How?

We have to look for inspiration from northern European countries who have comprehensive retraining, help with housing, help with relocation. Typically they have the unions, governments, and companies working together to try and keep the social cohesion. It doesn’t always work, but at least they try and most people feel that the government is helping them.

What about education?

We need to change the education system so you spend less time when you are young learning to be hyper-specialized and more lifelong learning. The jobs that will still be here will require face-to-face skills and making networks of human interactions work. Telepresence and telerobotics won’t replace those.

Given the backlash against globalization, and the way politicians are reacting to it, is there a possibility this phase of globalization won’t actually happen?

I don’t think you can stop it. There are very likely to be some nasty policies against it, but on the edge it’s going to happen.

http://qz.com/854257/brace-yourself-the-most-disruptive-phase-of-globalization-is-just-beginning/

Subscribe to:

Comments (Atom)