Amit Jeswani, Founder of India's 5th Largest Equity Advisory Company

Hi i am going to give you a Portfolio of Stocks rather than one stock.

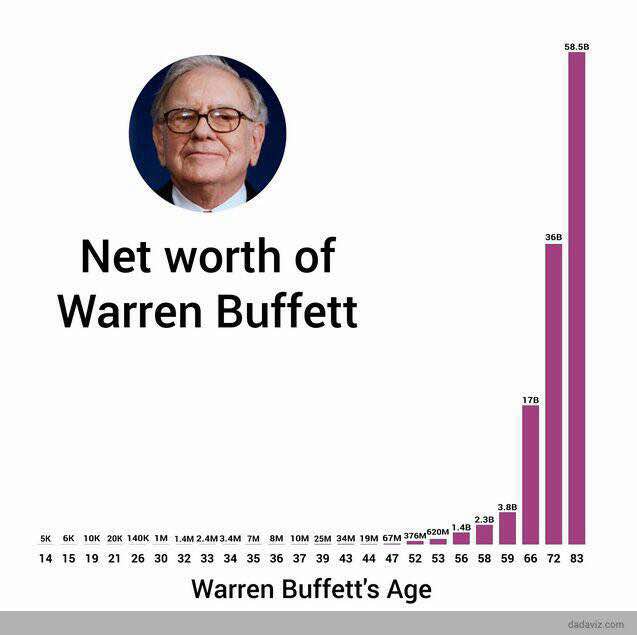

Today i am going to share Top 10 Stocks with you according to a strategy which is endorsed by Warren Buffet, written in “the little book that beats the Market” by Joel Greenblatt. Joel Greenblatt runs a hedge fund named Gotham Capital and has compounded capital at 40% for 20 years from 1985 to 2006.

In the Book, Joel Greenblatt gives out his Magic Formula. The Result’s of the Magic Formula in the US Markets have been Amazing and has delivered 30.8% between 1988 and 2004 with delivering negative returns only once.

SO WHAT EXACTLY IS THE MAGIC FORMULA?

The Magic Formula is Easy – Buy Good Companies for Cheap Valuation.

We Ranked all companies listed in Indian Stock market According to 2 main Factor’s of the Magic Formula

- Good Companies that have High Return on Capital Employed (ROCE)

- Cheap Companies that trade at a Low Enterprise Value to EBITDA Ratio (EV/EBITDA).

** Please note we have Excluded Holding Companies, Utilities and Financials.

Here is the list of top 10 stocks according to the Magic Formula.

Not all of these will be Multibagger, but these are good companies at below reasonable valuation. I haven’t Back tested this strategy in the Indian Stock Market, but in the US market this strategy has worked really well.

This is definitely not a Stock Recommendation but this strategy has worked really well. We will Review this strategy at the end of 2017. Incase your looking for the full Excel of This feel Free to Mail us at info@stallionasset.com and we will provide you for free.

Feel Free to Contact us on 02240033944