Sunday, 26 March 2017

The Best Free Investing Tools on the Web

Posted by Ben Carlson

One of the great things about the Internet is that it’s broken down many of the barriers to information that existed in the past. Investors can now become more informed than ever before if they know where to look and who to trust. You no longer have to go through the gatekeepers to access relevant financial market information.

This has leveled the playing field for the individual investor. With an abundance of information available, the winners and losers will be determined by those who are able to better process, filter and analyze the firehose of information that’s being put out there these days.

I spend a lot of time looking at historical market data and am always trying to figure out more efficient ways of doing so. While it can’t help me predict the future, it can help me analyze the present and assess probabilities from the past. Historical data does a better job predicting risk than returns but that’s about the best you can do in the absence of a functioning crystal ball. I prize evidence over opinions so I use a lot of back-tested data in my work.

I get a lot of questions from readers asking what data sources or models I use. I’ve been building my own excel models and formulas for a while and have access to a handful of professional subscription-based offerings. But you don’t have to spend tens of thousands of dollars on historical data providers to access useful financial data in the Internet age. There are plenty of really useful free websites out there that have historical market data, back-testing tools, risk statistics and scenario analysis capabilities.

Here are a number of them that I have found helpful over the years:

NYU’s stock, bond & cash historical returns

NYU professor Aswath Damodaran uses this site to update the performance numbers for stocks (S&P 500), bonds (10-year treasuries) and cash (3-month t-bills) once a year. It shows the annual returns for these three asset classes going all the way back to 1928. You can also download an excel file that contains historical interest rates, bond yields, and dividend yields. I use these numbers frequently.

NYU professor Aswath Damodaran uses this site to update the performance numbers for stocks (S&P 500), bonds (10-year treasuries) and cash (3-month t-bills) once a year. It shows the annual returns for these three asset classes going all the way back to 1928. You can also download an excel file that contains historical interest rates, bond yields, and dividend yields. I use these numbers frequently.

Portfolio Visualizer

This site has one of the best free asset allocation back-testing programs I’ve come across. There are probably 20-30 different asset classes and sub-asset classes you can back-test to the 1970s with historical returns, drawdowns, real (after-inflation) returns, and growth of your initial investment. This site also allows you to perform Monte Carlo simulations on withdrawal strategies, correlation matrixes between different assets, risk factor analysis and back-test real world portfolios using actual mutual funds and ETFs. That this website is available for free is pretty remarkable.

This site has one of the best free asset allocation back-testing programs I’ve come across. There are probably 20-30 different asset classes and sub-asset classes you can back-test to the 1970s with historical returns, drawdowns, real (after-inflation) returns, and growth of your initial investment. This site also allows you to perform Monte Carlo simulations on withdrawal strategies, correlation matrixes between different assets, risk factor analysis and back-test real world portfolios using actual mutual funds and ETFs. That this website is available for free is pretty remarkable.

Robert Shiller’s online data

Shiller has one of the longest running data sets I’ve seen. His famous CAPE spreadsheet has the monthly stock price, interest rate, earnings and dividend data going back to 1871. This site also has his comprehensive real estate data on home prices going back well over 100 years.

Shiller has one of the longest running data sets I’ve seen. His famous CAPE spreadsheet has the monthly stock price, interest rate, earnings and dividend data going back to 1871. This site also has his comprehensive real estate data on home prices going back well over 100 years.

Twitter

People on social media love to complain about social media but I find a ton of value in the information I receive from Twitter. I’m constantly finding helpful research, graphs, data and analysis that I wouldn’t be exposed to otherwise. Twitter is my go-to source for what’s going on in the world of finance and the markets along with under-the-radar research.

People on social media love to complain about social media but I find a ton of value in the information I receive from Twitter. I’m constantly finding helpful research, graphs, data and analysis that I wouldn’t be exposed to otherwise. Twitter is my go-to source for what’s going on in the world of finance and the markets along with under-the-radar research.

Fama-French

Ken French updates this site using much of the research he’s done over the years with Eugene Fama. This one is a factor investing nerd’s dream, although the site does take some time to figure out how to use efficiently (at least in my experience). French updates his data regularly with historical returns on factors such as small-cap stocks, value stocks, quality stocks and momentum stocks going back to the 1920s. This site also has great data on sector and industry historical returns. All of the data is easily exportable to excel.

Ken French updates this site using much of the research he’s done over the years with Eugene Fama. This one is a factor investing nerd’s dream, although the site does take some time to figure out how to use efficiently (at least in my experience). French updates his data regularly with historical returns on factors such as small-cap stocks, value stocks, quality stocks and momentum stocks going back to the 1920s. This site also has great data on sector and industry historical returns. All of the data is easily exportable to excel.

Credit Suisse Global Investment Returns Yearbook

Researchers Elroy Dimson, Paul March, and Mike Staunton update this report once a year with numbers on stocks, bonds, and inflation going back to 1900 for a number of different countries. It’s worth it to go through the entire report at least once.

Researchers Elroy Dimson, Paul March, and Mike Staunton update this report once a year with numbers on stocks, bonds, and inflation going back to 1900 for a number of different countries. It’s worth it to go through the entire report at least once.

MSCI

MSCI provides the most comprehensive free source of historical market data on foreign stock markets. They have performance numbers going back to 1970 for different countries, regions, and markets, both developed and emerging.

MSCI provides the most comprehensive free source of historical market data on foreign stock markets. They have performance numbers going back to 1970 for different countries, regions, and markets, both developed and emerging.

Abnormal Returns

The best curated content each and every day on investing, personal finance, research and anything else in the world of finance. If you miss anything worth reading you can be sure it will be here.

The best curated content each and every day on investing, personal finance, research and anything else in the world of finance. If you miss anything worth reading you can be sure it will be here.

Federal Reserve Economic Data (FRED)

Econ geeks love this site because the Federal Reserve has data on almost anything related to economics you can think of. There’s also plenty of good market data on stocks, bonds, and interest rates as well. And the site allows you to personalize the graphs and datasets.

Econ geeks love this site because the Federal Reserve has data on almost anything related to economics you can think of. There’s also plenty of good market data on stocks, bonds, and interest rates as well. And the site allows you to personalize the graphs and datasets.

Morningstar

I find that Morningstar has the best data on mutual funds and ETFs for performance purposes. You can see annual returns going back 10 years, and monthly and quarterly returns going back 5 years. They provide after-tax returns and fund behavior gaps, which I find really useful for seeing what investors are actually earning in these funds. You can also find breakdowns of fund holdings, investment styles, geographic allocations and more.

I find that Morningstar has the best data on mutual funds and ETFs for performance purposes. You can see annual returns going back 10 years, and monthly and quarterly returns going back 5 years. They provide after-tax returns and fund behavior gaps, which I find really useful for seeing what investors are actually earning in these funds. You can also find breakdowns of fund holdings, investment styles, geographic allocations and more.

Yahoo! Finance

I like Yahoo! Finance for daily historical data on stocks, interest rates, and indexes. They also have annual and quarterly performance numbers for mutual funds going back to inception, many of which give you decades of returns.

I like Yahoo! Finance for daily historical data on stocks, interest rates, and indexes. They also have annual and quarterly performance numbers for mutual funds going back to inception, many of which give you decades of returns.

Portfolio Charts

This is another great asset allocation back-testing tool that allows you to see how a number of different well-known portfolios have performed over the years. This site has the best visuals of any I’ve played around with. You can also stress-test a large number of asset classes and strategies.

This is another great asset allocation back-testing tool that allows you to see how a number of different well-known portfolios have performed over the years. This site has the best visuals of any I’ve played around with. You can also stress-test a large number of asset classes and strategies.

And here are a few more I’ve used over the years:

Feel free to shoot me an email if there are any that I’ve missed and I’ll be sure to add them to this list.

Further Reading:

On the Merits of Being a Financial Historian

On the Merits of Being a Financial Historian

Update: Here are the many suggestions I received from my readers for some of their favorites:

Thursday, 23 March 2017

Retail - “What’s going on is the customers don’t have the fucking money"; "Most of people's money is going into mortgage/auto loans"

The "Retail Apocalypse" Is Officially Descending Upon America

by Tyler Durden

Mar 23, 2017 6:55 PM

Consumerism has long been a defining element of American society, but retail giants are now shutting down thousands of their locations amid a long-anticipated “retail apocalypse."

BI reports that over the next couple months, more than 3,500 stores are expected to close:

“Department stores like JCPenney, Macy’s, Sears, and Kmart are among the companies shutting down stores, along with middle-of-the-mall chains like Crocs, BCBG, Abercrombie & Fitch, and Guess.”

Some stores, like Bebe and The Limited, are closing all of their locations to focus more on online sales. Other larger chains, like JC Penney, are “aggressively paring down their store counts to unload unprofitable locations and try to staunch losses,” Business Insider notes. Sears and K-Mart are following a similar trajectory moving forward.

Sears is shutting down 150 Sears and Kmart locations, about 10% of their shops. JCPenney is shutting down 138 stores, about 14% of their total locations.

These closures are the consequence of several different factors. First, the United States has more shopping mall square footage per person than other parts of the world. In America, retailers reserve 23.5 square feet per person; in Canada and Australia, the countries with the second- and third-most space have 16.4 and 11.1, respectively.

Another reason retail brick and mortars are failing is the growth of e-commerce. Between 2010 and 2013, visits to shopping malls declined 50%, according to data from real estate research firm Cushman and Wakefield. Meanwhile, online sales from huge online outposts, like Amazon, have exploded.

Back in 2015, Forbes observed this trend:

“Earlier this year, the stock market value of Amazon.com surpassed that of Walmart, a turn of events that many saw as indicative of how badly brick-and-mortar big box retailers have lagged behind in building up their e-commerce.”“Walmart is now hustling to bridge the gap, pouring billions into its tech to claw back some market share. Target, also a laggard, is similarly spending as much on tech as on its 1,800 stores. Both those companies, though, generate digital sales that are still only a small percentage of total sales, and a fraction of Amazon’s.”

At that time, Business Insider noted:

“The list of failures is getting longer by the day. Macy’s? Cooked – down 42% over the past six months. Nordstrom? Down 20% over the same timeframe. Dick’s Sporting Goods? Awful earnings sent this athletic retailer lower more than 10% yesterday alone. There’s absolutely no way to sugarcoat it—the retail sector is crashing.”

Though Americans increasingly prefer to shop online, their preferences are also changing. Shoppers are choosing to spend their money on “restaurants, travel, and technology than ever before, while spending less on apparel and accessories,” Business Insider reports.

Further, as longtime retail analyst Howard Davidowitz observed in 2014, “What’s going on is the customers don’t have the fucking money. That’s it. This isn’t rocket science.”

As prosperity declines, shopping habits shift, and major retailers like Macy’s, Sears, and JCPenney close their doors, their decisions are likely to have ripple effects on smaller stores in shopping malls. Business Insider explains that in addition to dwindling attendance and income for mall owners, major department store closures can trigger “‘co-tenancy clauses’ that allow the other mall tenants to terminate their leases or renegotiate the terms, typically with a period of lower rents, until another retailer moves into the anchor space.”

As fewer retail giants seek retail space, many malls are facing dire fates, and many expect low-performing malls to be hit hardest by the changing scope of retail, noting roughly 30% of malls will face increased risk of shutting down.

Shopping malls first became popular in the economically fruitful era of the 1950s and 60s. Inspired by major department stores of the 19th century — like Sears and Macy’s, which are now struggling — 20th-century malls grew rapidly, in part, because of government subsidies provided in the form of tax breaks. Smithsonian Magazine has explained that over the decades, real estate developers overshot their expectations, constructing increasing numbers of malls despite a lack of population growth. By 1999, the downward trend we see intensifying today had already begun:

“Shopping centers that hadn’t been renovated in years began to show signs of wear and tear, and the middle-aged, middle-class shoppers that once flooded their shops began to disappear, turning the once sterile suburban shopping centers into perceived havens for crime. Increasingly rundown and redundant, malls started turning into ghost towns—first losing shoppers and then losing stores.”

Almost twenty years later, the trend has only intensified, and retailers are evidently bracing for an even deeper plunge. As CNBC noted earlier this year:

“At $12.7 billion, U.S. department store revenue is $7.2 billion lower than it was in 2001, according to the U.S. Census Bureau. Expect these trends to continue.”

Comments

Déjà view Mano-A-Mano Mar 23, 2017 8:46 PM

Mortgage$/Auto loans consuming much discretionary income...

Squid Viscous GUS100CORRINA Mar 23, 2017 8:02 PM

meanwhile Panera and DOminos trade for 40x earnings.

folks still have money for shitty pizza and $9 sandwiches,?

scratching head...

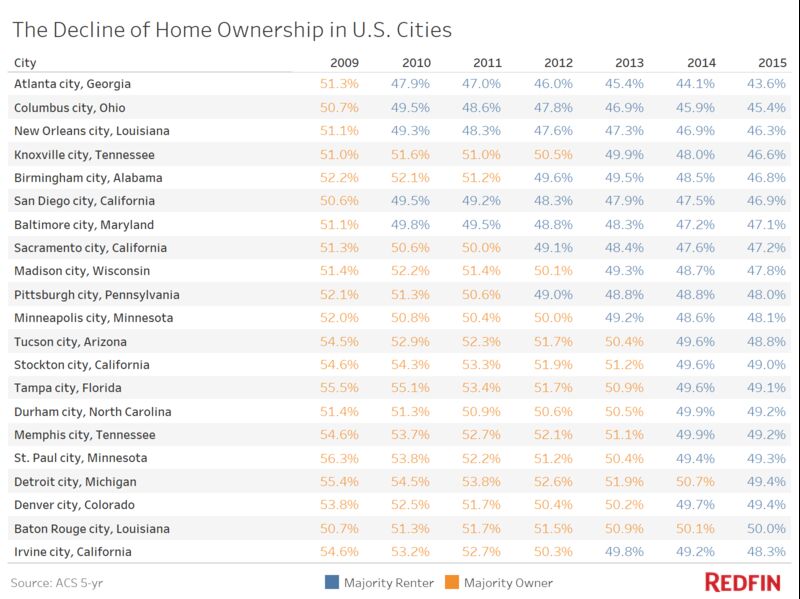

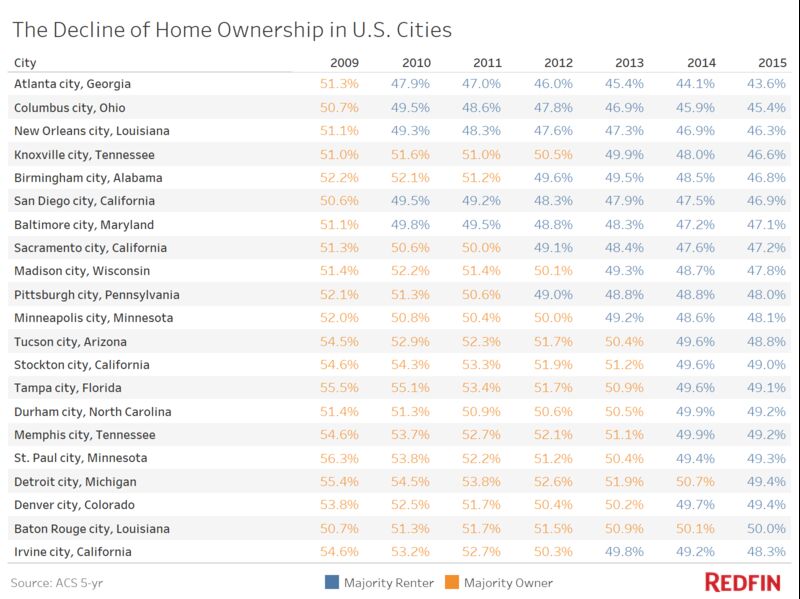

Shortage of affordable houses even in the US

Renters Now Rule Half of U.S. Cities

The American Dream increasingly involves a lease, not a mortgage.

by Patrick Clark

March 23, 2017, 2:30 PM GMT+5:30

Just 49 percent of Motor City households were homeowners in 2015, down from 55 percent in 2009 and the lowest percentage in more than 50 years. Detroit isn’t alone, of course: The rate of U.S. home ownership fell steadily for a decade as the foreclosure crisis turned millions of owners into renters and tight housing markets made it hard for renters to buy homes. Demographic shifts—millennials (finally) moving out of their parents basements, for instance, or a rising Hispanic population—further fed the renter pool.

Fifty-two of the 100 largest U.S. cities were majority-renter in 2015, according to U.S. Census Bureau data compiled for Bloomberg by real estate brokerage Redfin. Twenty-one of those cities have shifted to renter-domination since 2009. These include such hot housing markets as Denver and San Diego and lukewarm locales, such as Detroit and Baltimore, better known for vacant homes than residential development.

While U.S. home ownership ticked up in the second half of 2016, there are reasons to think the trend toward renting will continue. A 2015 report from the Urban Institute predicted that rentership would keep rising through 2030, thanks to demographic trends that include aging baby boomers who downsize into rentals.

In the shorter term, housing market dynamics will also play a role. Fewer than 1 million homes were on the market in the first quarter of 2017, the lowest number since Trulia began recording inventory data in 2012. The shortage makes it harder for renters to buy. Meanwhile, rental landlords, including large Wall Street players and mom-and-pop investors, continue to plow cash into single-family homes.

Those shifts are likely to present new challenges for cities unequipped to handle high rental populations. Detroit Future City, a nonprofit that highlighted Detroit’s shift in a report earlier this month, argues that the city needs an intentional strategy for dealing with the rising population of such households.

That could include providing new protections for renters or creating resources to help landlords keep properties in good repair. On a grander scale, the Center for Budget Policy & Priorities, a Washington-based research institute, published a proposal this month calling for a new tax credit for low-wage workers, seniors, and people for disabilities.

Most low-income families don’t rent by choice, said Nela Richardson, chief economist at Redfin. And plenty of higher-income households rent because they can’t afford to buy. “We don’t have enough affordable supply in either rental or for-sale markets,” said Richardson, adding that cities interested in promoting renter-friendly policies can rethink their zoning policies to encourage more construction.

At an even more basic level, city leaders should check old assumptions about the role renter households play in their communities, said Andrew Jakabovics, vice president for policy development at Enterprise Community Partners, an affordable housing nonprofit.

Homeowners have traditionally been regarded as more engaged, with more at stake in the long-term prospects of their neighborhood, Jakabovics said. That view can unfairly shortchange renters.

“It goes a long way just to make sure you’re valuing renters and making sure voices are heard when it’s time to allocate resources to schools or parks or transit lines,” he said

https://www.bloomberg.com/news/articles/2017-03-23/renters-now-rule-half-of-u-s-cities

The American Dream increasingly involves a lease, not a mortgage.

by Patrick Clark

March 23, 2017, 2:30 PM GMT+5:30

Just 49 percent of Motor City households were homeowners in 2015, down from 55 percent in 2009 and the lowest percentage in more than 50 years. Detroit isn’t alone, of course: The rate of U.S. home ownership fell steadily for a decade as the foreclosure crisis turned millions of owners into renters and tight housing markets made it hard for renters to buy homes. Demographic shifts—millennials (finally) moving out of their parents basements, for instance, or a rising Hispanic population—further fed the renter pool.

Fifty-two of the 100 largest U.S. cities were majority-renter in 2015, according to U.S. Census Bureau data compiled for Bloomberg by real estate brokerage Redfin. Twenty-one of those cities have shifted to renter-domination since 2009. These include such hot housing markets as Denver and San Diego and lukewarm locales, such as Detroit and Baltimore, better known for vacant homes than residential development.

While U.S. home ownership ticked up in the second half of 2016, there are reasons to think the trend toward renting will continue. A 2015 report from the Urban Institute predicted that rentership would keep rising through 2030, thanks to demographic trends that include aging baby boomers who downsize into rentals.

In the shorter term, housing market dynamics will also play a role. Fewer than 1 million homes were on the market in the first quarter of 2017, the lowest number since Trulia began recording inventory data in 2012. The shortage makes it harder for renters to buy. Meanwhile, rental landlords, including large Wall Street players and mom-and-pop investors, continue to plow cash into single-family homes.

Those shifts are likely to present new challenges for cities unequipped to handle high rental populations. Detroit Future City, a nonprofit that highlighted Detroit’s shift in a report earlier this month, argues that the city needs an intentional strategy for dealing with the rising population of such households.

That could include providing new protections for renters or creating resources to help landlords keep properties in good repair. On a grander scale, the Center for Budget Policy & Priorities, a Washington-based research institute, published a proposal this month calling for a new tax credit for low-wage workers, seniors, and people for disabilities.

Most low-income families don’t rent by choice, said Nela Richardson, chief economist at Redfin. And plenty of higher-income households rent because they can’t afford to buy. “We don’t have enough affordable supply in either rental or for-sale markets,” said Richardson, adding that cities interested in promoting renter-friendly policies can rethink their zoning policies to encourage more construction.

At an even more basic level, city leaders should check old assumptions about the role renter households play in their communities, said Andrew Jakabovics, vice president for policy development at Enterprise Community Partners, an affordable housing nonprofit.

Homeowners have traditionally been regarded as more engaged, with more at stake in the long-term prospects of their neighborhood, Jakabovics said. That view can unfairly shortchange renters.

“It goes a long way just to make sure you’re valuing renters and making sure voices are heard when it’s time to allocate resources to schools or parks or transit lines,” he said

https://www.bloomberg.com/news/articles/2017-03-23/renters-now-rule-half-of-u-s-cities

Sears Today, Walmart Tomorrow? Why You Don't Want To Own Any Retail Stocks

MAR 22, 2017 @ 07:50 PM 11,847 VIEWS The Little Black Book of Billionaire Secrets

Adam Hartung , CONTRIBUTOR

I cover business growth & overcoming organizational obstacles.

Opinions expressed by Forbes Contributors are their own.

Traditional retailers just keep providing more bad news. Payless Shoes said it plans to file bankruptcy next week, closing 500 of its 4,000 stores. Most likely it will follow the path of Radio Shack, which hasn't made a profit since 2011. Radio Shack filed bankruptcy, and shut a gob of stores as part of its "turnaround plan." Then in February Radio Shack filed its second bankruptcy - most likely killing the chain entirely this time.

Sears Holdings finally admitted it probably can't survive as a going concern this week. Sears has lost over $10B since 2010 - when it last showed a profit - and owes over $4B to its creditors. Retail stocks cratered Monday as the list of retailers closing stores accelerated: Sears, KMart, Macy's, Radio Shack, JCPenney, American Apparel, Abercrombie & Fitch, The Limited, CVS, GNC, Office Depot, HHGregg, The Children's Place, and Crocs are just some of the household names that are slowly (or not so slowly) dying.

None of this should be surprising. By the time CEO Ed Lampert merged KMart with Sears the trend to e-commerce was already pronounced. Anyone could build an excel spreadsheet that would demonstrate as on-line retail grew, brick-and-mortar retail would decline. In the low margin world of retail, profits would evaporate. It would be a blood bath. Any retailer with any weakness simply would not survive this market shift - and that clearly included outdated store concepts like Sears, KMart and Radio Shack which long ago were outflanked by on-line shopping and trendier storefronts.

Yet, not everyone is ready to give up on some retailers. Walmart, for example, still trades at $70/share, which is higher than it traded in 2015 and about where it traded back in 2012. Some investors still think that there are brick-and-mortar outfits that are either immune to the trends, or will survive the shake-out and have higher profits in the future.

And that is why we have to be very careful about business myths.

There are a lot of people that believe as markets shrink the ultimate consolidation will leave one, or a few, competitors who will be very profitable. Capacity will go away, and profits will return. In the end, they believe if you are the last buggy whip maker you will be profitable - so investors just need to pick who will be the survivor and wait it out. And, if you believe this, then you have justified owning Walmart.

Only, markets don't work that way. As industries consolidate they end up with competitors who either lose money, or just barely eke out a small profit. Think about the auto industry, airlines or land-line telecom companies.

Two factors exist which effectively forces all the profits out of these businesses, and therefore make it impossible for investors to make money long-term.

First,competitive capacity always remains just a bit too much for the market need. Management, and often investors, simply don't want to give up in the face of industry consolidation. They keep hoping to reach a rainbow that will save them. So capacity lingers and lingers - always pushing prices down even as costs increase. Even after someone fails, and that capacity theoretically goes away, someone jumps in with great hopes for the future and boosts capacity again. Therefore, excess capacity overhangs the marketplace forcing prices down to break-even, or below, and never really goes away.

Given the amount of retail real estate out there, and the bargains being offered to anyone who wants to open, or expand, stores this problem will persist for decades in retail.

Second, demand in most markets keeps declining. Hopefuls project that demand will "stabilize," thus balancing the capacity and allowing for price increases. Because demand changes aren't linear, there are often plateaus that make it appear as if demand won't go down more. But then something changes - an innovation, regulatory change, taste change - and demand takes another hit. And all the hope goes away as profits drop, again.

It is not a successful strategy to try being the "last man standing" in any declining market. No competitor is immune to these forces when markets shift. No matter how big, when trends shift and new forms of competition start growing every old-line company will be negatively affected. Whether fast, or slow, the value of these companies will continue declining until they eventually become worthless.

Nor is it successful long-term to try and segment the business into small groupings which management thinks can be protected. When Xerox brought to market photocopying, small offset press manufacturers (ABDick and Multigraphics ) said not to worry. Xeroxing might be OK in some office installations, but there were customer segments that would forever use lithography. Even as demand shrunk, well into the 1990s, they said that big corporations, industrial users, government entities, schools and other segments would forever need the benefits of lithography, so investors were safe. Today the small offset press market is a tiny fraction of its size in the 1960s. ABDick and Multigraphics both went through rounds of bankruptcies before disappearing. Xerography, its child desktop publishing, and its grandchild electronic screens, killed offset for almost all applications.

So don't be lured into false hopes by retailers who claim their segment is "protected." Short-term things might not look bad. But the market has already shifted to e-commerce, and this is just round one of change. More and more innovations are coming that will make the need for traditional stores increasingly unnecessary.

Many readers have expressed their disappointment in my chronic warnings about Walmart. But those warnings are no different than my warnings about Sears Holdings. It's just that the timing may be different. Both companies have been over-investing in assets (brick-and-mortar stores) that are declining in value as they have attempted to defend and extend their old business model. Both radically under-invested in new markets which were cannibalizing their old business. And, in the end, both will end up with the same results.

And this is true for all retailers that depend on traditional brick-and-mortar sales for their revenues and profits - it's only a matter of when things will go badly, not if. So traditional retail is nowhere that any investor wants to be.

Learn more about trend planning at AdamHartung.com, or connect with me on LinkedIn, Facebook and Twitter.

Adam Hartung , CONTRIBUTOR

I cover business growth & overcoming organizational obstacles.

Opinions expressed by Forbes Contributors are their own.

Traditional retailers just keep providing more bad news. Payless Shoes said it plans to file bankruptcy next week, closing 500 of its 4,000 stores. Most likely it will follow the path of Radio Shack, which hasn't made a profit since 2011. Radio Shack filed bankruptcy, and shut a gob of stores as part of its "turnaround plan." Then in February Radio Shack filed its second bankruptcy - most likely killing the chain entirely this time.

Sears Holdings finally admitted it probably can't survive as a going concern this week. Sears has lost over $10B since 2010 - when it last showed a profit - and owes over $4B to its creditors. Retail stocks cratered Monday as the list of retailers closing stores accelerated: Sears, KMart, Macy's, Radio Shack, JCPenney, American Apparel, Abercrombie & Fitch, The Limited, CVS, GNC, Office Depot, HHGregg, The Children's Place, and Crocs are just some of the household names that are slowly (or not so slowly) dying.

None of this should be surprising. By the time CEO Ed Lampert merged KMart with Sears the trend to e-commerce was already pronounced. Anyone could build an excel spreadsheet that would demonstrate as on-line retail grew, brick-and-mortar retail would decline. In the low margin world of retail, profits would evaporate. It would be a blood bath. Any retailer with any weakness simply would not survive this market shift - and that clearly included outdated store concepts like Sears, KMart and Radio Shack which long ago were outflanked by on-line shopping and trendier storefronts.

Yet, not everyone is ready to give up on some retailers. Walmart, for example, still trades at $70/share, which is higher than it traded in 2015 and about where it traded back in 2012. Some investors still think that there are brick-and-mortar outfits that are either immune to the trends, or will survive the shake-out and have higher profits in the future.

And that is why we have to be very careful about business myths.

There are a lot of people that believe as markets shrink the ultimate consolidation will leave one, or a few, competitors who will be very profitable. Capacity will go away, and profits will return. In the end, they believe if you are the last buggy whip maker you will be profitable - so investors just need to pick who will be the survivor and wait it out. And, if you believe this, then you have justified owning Walmart.

Only, markets don't work that way. As industries consolidate they end up with competitors who either lose money, or just barely eke out a small profit. Think about the auto industry, airlines or land-line telecom companies.

Two factors exist which effectively forces all the profits out of these businesses, and therefore make it impossible for investors to make money long-term.

First,competitive capacity always remains just a bit too much for the market need. Management, and often investors, simply don't want to give up in the face of industry consolidation. They keep hoping to reach a rainbow that will save them. So capacity lingers and lingers - always pushing prices down even as costs increase. Even after someone fails, and that capacity theoretically goes away, someone jumps in with great hopes for the future and boosts capacity again. Therefore, excess capacity overhangs the marketplace forcing prices down to break-even, or below, and never really goes away.

Given the amount of retail real estate out there, and the bargains being offered to anyone who wants to open, or expand, stores this problem will persist for decades in retail.

Second, demand in most markets keeps declining. Hopefuls project that demand will "stabilize," thus balancing the capacity and allowing for price increases. Because demand changes aren't linear, there are often plateaus that make it appear as if demand won't go down more. But then something changes - an innovation, regulatory change, taste change - and demand takes another hit. And all the hope goes away as profits drop, again.

It is not a successful strategy to try being the "last man standing" in any declining market. No competitor is immune to these forces when markets shift. No matter how big, when trends shift and new forms of competition start growing every old-line company will be negatively affected. Whether fast, or slow, the value of these companies will continue declining until they eventually become worthless.

Nor is it successful long-term to try and segment the business into small groupings which management thinks can be protected. When Xerox brought to market photocopying, small offset press manufacturers (ABDick and Multigraphics ) said not to worry. Xeroxing might be OK in some office installations, but there were customer segments that would forever use lithography. Even as demand shrunk, well into the 1990s, they said that big corporations, industrial users, government entities, schools and other segments would forever need the benefits of lithography, so investors were safe. Today the small offset press market is a tiny fraction of its size in the 1960s. ABDick and Multigraphics both went through rounds of bankruptcies before disappearing. Xerography, its child desktop publishing, and its grandchild electronic screens, killed offset for almost all applications.

So don't be lured into false hopes by retailers who claim their segment is "protected." Short-term things might not look bad. But the market has already shifted to e-commerce, and this is just round one of change. More and more innovations are coming that will make the need for traditional stores increasingly unnecessary.

Many readers have expressed their disappointment in my chronic warnings about Walmart. But those warnings are no different than my warnings about Sears Holdings. It's just that the timing may be different. Both companies have been over-investing in assets (brick-and-mortar stores) that are declining in value as they have attempted to defend and extend their old business model. Both radically under-invested in new markets which were cannibalizing their old business. And, in the end, both will end up with the same results.

And this is true for all retailers that depend on traditional brick-and-mortar sales for their revenues and profits - it's only a matter of when things will go badly, not if. So traditional retail is nowhere that any investor wants to be.

Learn more about trend planning at AdamHartung.com, or connect with me on LinkedIn, Facebook and Twitter.

Tuesday, 21 March 2017

Thursday, 16 March 2017

Wednesday, 15 March 2017

Bajaj Auto moving towards 'premiumization' - everyone from FMCG companies to 2-wheelers to cars seem to be moving towards premiumization

Mar 15, 2017 02:27 PM IST | Source: Moneycontrol.com

Rajiv Bajaj on demonetisation and why 100cc bikes don't have a future

Rajiv Bajaj tells Moneycontrol why Bajaj Auto will continue to focus on premium bikes and outlines the impact of demonetisation.

BySwaraj Baggonkar

Following the 2012-13 economic slowdown, Bajaj Auto saw its market share come off steeply as demand for its premium bikes, especially the Pulsar, took a hit.

The company's strategy came in for criticism but MD Rajiv Bajaj made it clear: its high-margin, premium two-wheeler segment would continue to remain its core focus.

Of the 16 models that Bajaj Auto currently produces for the domestic market, only two models – Platina and CT100 – are in the budget segment while the rest have engines of 125cc and above. Two of its bikes, Dominar 400 and RS200, are priced above Rs 1 lakh.

In an exclusive interview with Moneycontrol's Swaraj Baggonkar, Bajaj talked about how the company's market share made a comeback during the past few years as the premium bike market recovered and why he believes focusing on the 100cc motorcycle -- currently the bread-and-butter for many of Bajaj's rivals -- does not make long-term sense ("it is the bicycle of the future").

The outspoken industrialist has also been one of the few to have voiced his opinion against the government's demonetisation move.

In the interview, he discussed its impact.

Bajaj has had a very busy year so far. Will that momentum continue in FY18?

If you look at January 2015 our domestic market share was around 14 percent and if see where it stands now particularly at the retail level it is a shade above 20 percent. Unfortunately, in the last few months, all this confusion about demonetization and BS-III stocks has queered the pitch a little.

So, this is extremely significant. Before demonetization the size of the domestic motorcycle industry was a little over 900,000 a month. And, therefore, 6 percent of that would be about 55,000 motorcycles a month. So when we consider we have gained 6 percent share it is double the market share of global players like Yamaha who has been here for almost 35 years. The 55,000 volume [figure] is also the monthly volume of a TVS Motors or a Royal Enfield. So, I would say that what we have gained in terms of share or volume is equal to the absolute share of volume of a secondary player in the market place. In that sense I would say it is a very significant gain.

There were plenty of new launches this year from Bajaj. What will be the guidance for FY18?

In terms of product development one does not talk of months. We talk of at least a two-year time-frame. It takes that much lead time to create something even if that is not totally new in terms of changing an existing product. If I take a two-year perspective I would say our aim would be to do more of the same. In the next two years we can gain another 5-6 percentage points. There are several new launches; some of them will be in FY18 and some are scheduled after that. But yes the short answer would be that whatever we have achieved in the last two years in terms of incremental share and volume -- we would like to grow them.

Tackling demonetization was undoubtedly the most challenging part of the business this year. Has this impacted the psyche of the two-wheeler buyer?

Definitely, there is an impact [of demonetization] on the industry. I explained how the industry from being in a positive area has gone into a distinctly negative [zone] after November 8. I had tried to make a point that somebody like Bajaj may feel less affected, down only 5 percent year-on-year. But the reality is that by October we were growing 20 percent year-on-year in the domestic market. So being in a position where you were plus 20 percent and suddenly become minus 5 percent -- it is a very dramatic loss of momentum.

Obviously, this affects people both materially and also in sentiment. One can see that the rural places are more affected; the cheaper 100cc bikes were more affected than premium motorcycles. We have been able to put some colour on numbers and see the qualitative impact along with the quantitative impact. In terms of recovery there is no doubt, I have already said that after mid-December or let’s say from January things have been improving but definitely our view is that it is still not normalised.

Exports have been a cause of concern for Bajaj?

Exports had started coming under pressure once oil got into trouble and it has troubled several of our markets in Africa and Columbia. While those places continue to be under pressure we are not in a position to say that suddenly everything looks hunky-dory there. But definitely things have been improving in the last two months. In February our exports were 85,000 last year but this year they are 105,000. On the other hand three-wheelers have yet to recover. Soon we are going to Malaysia and Thailand and definitely Dominar will be one of the brands that we would like to introduce there.

How are the new launches doing?

We sold close to 3,300 units of Dominar 400. As far as I know everything that is going to dealers is sold out. I hope we are going to achieve the target of over 5,000 this month. The other important thing is that the bike has a lot of interest in our export market. So far we have not started with exports. From this month or perhaps from next month, depending on production capacity, we will start exports and I am hopeful that we will get a good reception in the export market. We had indicated that by September this year we will like to hit 10,000 and we feel we are on track for that.

How are we doing on production capacity utilization? And, is the existing capacity good enough to last long?

Right now we are fine. Our capacity is around 5 million vehicles; it depends on the product mix. We have started at the rate of 4 million vehicles a year. So, I don’t think there is any immediate need to expand capacity. We don’t need to take the decision too much in advance because it does not take more than a few months to up the capacity.

Will there be adjustments to the product mix?

One of the things we as a team have come to a conclusion is that even if we start filling capacity to 100 percent a lot of capacity would be filled by cheaper and less profitable 100cc motorcycles. That would be by the Boxer brand which is primarily exported. Now, it is very less than earlier because of collapse of Nigeria. Otherwise, Nigeria itself would have been alone 40,000 Boxers. But even now Boxer is doing 50,000 units a month. And CT100 is another 40,000-50,000 and Platina is 30,000-35,000 a month. We are talking of something like 1.3 lakh a month and 1.5 million a year. As a company we have always said that technology, quality, profitability, for us is far more important than just simple volumes and markets share and scale. So brands like Boxer, CT100, Platina are having a lower single digit EBITDA margin compared to some of the other brands we have. What we have decided as a company is that even if tomorrow we are making 5 million from the current 4 million vehicles and instead of one and half million vehicles we make may be 2 million 100cc motorcycles, let’s say rural markets come back, Nigeria comes back but we will not then increase capacity beyond 5 million.

The 100cc segment has been falling consistently. What is its future?

In five years hopefully when people look back they will say we did the right thing. I think the 100cc of today is the bicycle of the future. And, it will always be popular, serve the purpose, but they will be so far down at the bottom of the pyramid. A company like ours is not trying to make a little bit of everything and participate in all segments - scooter, motorcycle, cheap, expensive. We are very clear. We want to do one thing and we want to be the best in that. I think we cannot reach to the bottom of the barrel because in terms of technology, quality and margins these motorcycles become very unattractive.

The 100cc has been shrinking. It has been more or less 50 percent of the industry or less than that. So I don’t think 100cc has much of a future going forward. Now that does not mean it will be gone in five years. It (also) does not mean we are exiting the segment. All I am saying is that when the time comes I have two options – should I increase capacity from 5 million to 6 million or should I prune the 100cc a bit and the way to prune it is not to discontinue a model but raising the price a little bit and improve profitability. And that (freed) capacity we will put for bigger bikes, three-wheelers or quadricycles. This will make our production mix even richer. A lot of carmakers are already doing this. The rat race of 100cc, living on month-to-month, I don’t think that is the way for business in the future. I am forecasting that this is how we will respond to a situation that demands a capacity increase.

The company's strategy came in for criticism but MD Rajiv Bajaj made it clear: its high-margin, premium two-wheeler segment would continue to remain its core focus.

Of the 16 models that Bajaj Auto currently produces for the domestic market, only two models – Platina and CT100 – are in the budget segment while the rest have engines of 125cc and above. Two of its bikes, Dominar 400 and RS200, are priced above Rs 1 lakh.

In an exclusive interview with Moneycontrol's Swaraj Baggonkar, Bajaj talked about how the company's market share made a comeback during the past few years as the premium bike market recovered and why he believes focusing on the 100cc motorcycle -- currently the bread-and-butter for many of Bajaj's rivals -- does not make long-term sense ("it is the bicycle of the future").

The outspoken industrialist has also been one of the few to have voiced his opinion against the government's demonetisation move.

In the interview, he discussed its impact.

Bajaj has had a very busy year so far. Will that momentum continue in FY18?

If you look at January 2015 our domestic market share was around 14 percent and if see where it stands now particularly at the retail level it is a shade above 20 percent. Unfortunately, in the last few months, all this confusion about demonetization and BS-III stocks has queered the pitch a little.

So, this is extremely significant. Before demonetization the size of the domestic motorcycle industry was a little over 900,000 a month. And, therefore, 6 percent of that would be about 55,000 motorcycles a month. So when we consider we have gained 6 percent share it is double the market share of global players like Yamaha who has been here for almost 35 years. The 55,000 volume [figure] is also the monthly volume of a TVS Motors or a Royal Enfield. So, I would say that what we have gained in terms of share or volume is equal to the absolute share of volume of a secondary player in the market place. In that sense I would say it is a very significant gain.

There were plenty of new launches this year from Bajaj. What will be the guidance for FY18?

In terms of product development one does not talk of months. We talk of at least a two-year time-frame. It takes that much lead time to create something even if that is not totally new in terms of changing an existing product. If I take a two-year perspective I would say our aim would be to do more of the same. In the next two years we can gain another 5-6 percentage points. There are several new launches; some of them will be in FY18 and some are scheduled after that. But yes the short answer would be that whatever we have achieved in the last two years in terms of incremental share and volume -- we would like to grow them.

Tackling demonetization was undoubtedly the most challenging part of the business this year. Has this impacted the psyche of the two-wheeler buyer?

Definitely, there is an impact [of demonetization] on the industry. I explained how the industry from being in a positive area has gone into a distinctly negative [zone] after November 8. I had tried to make a point that somebody like Bajaj may feel less affected, down only 5 percent year-on-year. But the reality is that by October we were growing 20 percent year-on-year in the domestic market. So being in a position where you were plus 20 percent and suddenly become minus 5 percent -- it is a very dramatic loss of momentum.

Obviously, this affects people both materially and also in sentiment. One can see that the rural places are more affected; the cheaper 100cc bikes were more affected than premium motorcycles. We have been able to put some colour on numbers and see the qualitative impact along with the quantitative impact. In terms of recovery there is no doubt, I have already said that after mid-December or let’s say from January things have been improving but definitely our view is that it is still not normalised.

Exports have been a cause of concern for Bajaj?

Exports had started coming under pressure once oil got into trouble and it has troubled several of our markets in Africa and Columbia. While those places continue to be under pressure we are not in a position to say that suddenly everything looks hunky-dory there. But definitely things have been improving in the last two months. In February our exports were 85,000 last year but this year they are 105,000. On the other hand three-wheelers have yet to recover. Soon we are going to Malaysia and Thailand and definitely Dominar will be one of the brands that we would like to introduce there.

How are the new launches doing?

We sold close to 3,300 units of Dominar 400. As far as I know everything that is going to dealers is sold out. I hope we are going to achieve the target of over 5,000 this month. The other important thing is that the bike has a lot of interest in our export market. So far we have not started with exports. From this month or perhaps from next month, depending on production capacity, we will start exports and I am hopeful that we will get a good reception in the export market. We had indicated that by September this year we will like to hit 10,000 and we feel we are on track for that.

How are we doing on production capacity utilization? And, is the existing capacity good enough to last long?

Right now we are fine. Our capacity is around 5 million vehicles; it depends on the product mix. We have started at the rate of 4 million vehicles a year. So, I don’t think there is any immediate need to expand capacity. We don’t need to take the decision too much in advance because it does not take more than a few months to up the capacity.

Will there be adjustments to the product mix?

One of the things we as a team have come to a conclusion is that even if we start filling capacity to 100 percent a lot of capacity would be filled by cheaper and less profitable 100cc motorcycles. That would be by the Boxer brand which is primarily exported. Now, it is very less than earlier because of collapse of Nigeria. Otherwise, Nigeria itself would have been alone 40,000 Boxers. But even now Boxer is doing 50,000 units a month. And CT100 is another 40,000-50,000 and Platina is 30,000-35,000 a month. We are talking of something like 1.3 lakh a month and 1.5 million a year. As a company we have always said that technology, quality, profitability, for us is far more important than just simple volumes and markets share and scale. So brands like Boxer, CT100, Platina are having a lower single digit EBITDA margin compared to some of the other brands we have. What we have decided as a company is that even if tomorrow we are making 5 million from the current 4 million vehicles and instead of one and half million vehicles we make may be 2 million 100cc motorcycles, let’s say rural markets come back, Nigeria comes back but we will not then increase capacity beyond 5 million.

The 100cc segment has been falling consistently. What is its future?

In five years hopefully when people look back they will say we did the right thing. I think the 100cc of today is the bicycle of the future. And, it will always be popular, serve the purpose, but they will be so far down at the bottom of the pyramid. A company like ours is not trying to make a little bit of everything and participate in all segments - scooter, motorcycle, cheap, expensive. We are very clear. We want to do one thing and we want to be the best in that. I think we cannot reach to the bottom of the barrel because in terms of technology, quality and margins these motorcycles become very unattractive.

The 100cc has been shrinking. It has been more or less 50 percent of the industry or less than that. So I don’t think 100cc has much of a future going forward. Now that does not mean it will be gone in five years. It (also) does not mean we are exiting the segment. All I am saying is that when the time comes I have two options – should I increase capacity from 5 million to 6 million or should I prune the 100cc a bit and the way to prune it is not to discontinue a model but raising the price a little bit and improve profitability. And that (freed) capacity we will put for bigger bikes, three-wheelers or quadricycles. This will make our production mix even richer. A lot of carmakers are already doing this. The rat race of 100cc, living on month-to-month, I don’t think that is the way for business in the future. I am forecasting that this is how we will respond to a situation that demands a capacity increase.

Subscribe to:

Comments (Atom)